Side Events: Insurance and Risk Finance at the 4th International Conference on Financing for Development

Side Events: Insurance and Risk Finance at the 4th International Conference on Financing for Development

FIBES Sevilla Exhibition and Conference Centre, Sevilla, Spain

30 June- 3 July 2025

As 2025 unfolds with increasing disruption and uncertainty, developing countries are anticipating new ways to mobilize finance and transform their societies and economies across all dimensions of development.

Against this backdrop, governments will convene at the Fourth International Conference on Financing for Development (FfD4) in Sevilla, Spain from June 30 to July 3, 2025, to discuss the implementation of the new global development financing framework - the ‘Compromiso de Sevilla’. The FfD4 convening in Sevilla is a once in a decade opportunity for leaders from all countries to reset the financial system and shape a new sustainable development finance narrative.

Join UNDP’s Insurance and Risk Finance Facility in discussion at our FfD4 side events. Co-hosted with public and private partners, these events are part of a broader dialogue and coordinated effort to integrate insurance and risk management more prominently into development financing frameworks and strategies.

Full list of in person FfD4 side events hosted by UNDP ⏐ All FfD4 in-person side events

Read the final outcome document for the Fourth International Conference on Financing for Development, the Compromiso de Sevilla (the Seville Commitment), which is intended as the cornerstone of a renewed global framework for financing sustainable development. Compromiso de Sevilla

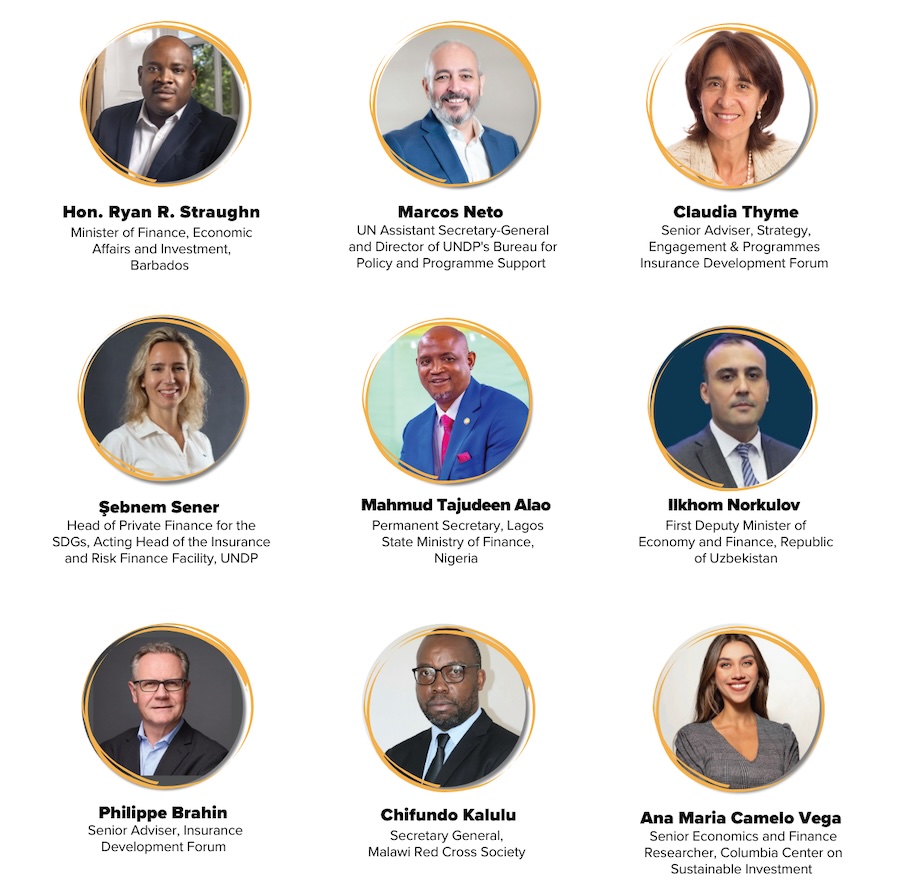

Harnessing Insurance Industry Capabilities for Development

Hosted by UNDP in partnership with the Insurance Development Forum

Date: 2.07.2025

Time: 4:30pm - 5:45pm CET

Location: Side Event Room 12

Event Background

Immense investment needs and financial reform will define negotiations for a new global development financing framework at the Fourth International Conference on Financing for Development (FfD4). The sustainable development financing gap has reached US$4 trillion annually, and could climb to US$6.4 trillion by 2030. At the same time, this US$4 trillion financing gap represents less than 1% of the US$461 trillion in global financial assets, and 10% of the $40 trillion in financial assets managed by the global insurance industry alone.

Expanding use of the industry’s full set of capabilities - risk insights, underwriting and investment functions can support resilience and contribute to SDG-aligned investment in developing countries. The positive correlation between insurance and SDGs has been modeled, with one example showing that for every 1% increase in Property and Casualty insurance penetration in a country, the SDG Index increases by an average of 5.8 points.

Recognising the virtuous cycle of insurance, investment and economic growth, the Bridgetown Initiative Version 3.0 underscores viable insurance markets as a precondition for governments, businesses and individuals to invest, whether in infrastructure, homes or climate-smart agri-technology. A new generation of public private insurance partnerships are also emerging to address the risks faced by communities through local insurance market transformation.

This FfD4 side-event will spotlight current and proposed actions and efforts to deepen the insurance industry’s contribution to resilience as a foundation for sustainable development. Speakers will highlight examples and opportunities for insurance initiatives to protect countries’ economic and social development gains while enabling future investments towards achieving the SDGs.

The discussion will include insights from the new Bridgetown Initiative-Insurance Development Forum report ‘From Risk to Resilience: How Insurance can Mobilize Disaster Finance and Climate Investment in Vulnerable Economies’

Financing the Future: Resilience, Reconstruction, and Innovative financing in Fragile Contexts

Hosted by the Islamic development Bank in partnership with UNDP

Date: 1.07.2025

Time: 12:30pm - 2:00pm CET

Location: Side Event Room 18

Event Background

Through this high-level discussion, stakeholders can forge a shared understanding of the unique financing challenges and opportunities in fragile and conflict-affected settings facing climate shocks. The panel can catalyze momentum around the need for more flexible, risk-tolerant, and context-sensitive financing models that bridge the gap between humanitarian relief, climate adaptation, and sustainable reconstruction. By convening diverse actors, including governments, donors, multilateral banks, private investors, insurance and Takaful companies, local leaders, and civil society the discussion can surface practical solutions, highlight successful innovations, and identify concrete pathways to unlock and scale resources for climate-resilient recovery. Importantly, it can also elevate the voices of those most affected, promoting inclusive approaches that empower local institutions and communities. The outcomes of the panel can inform global policy processes, shape donor strategies, and help lay the groundwork for a more coherent, anticipatory, and equitable financing architecture for recovery and reconstruction in the age of compounding crises.

Objectives of the high-level side event

- Promote innovative, sustained, and adaptive financing instruments: Explore the potential of financing solutions that are flexible, timely, and risk-tolerant—such as forecast-based financing and area-based recovery funds—particularly suited to volatile FCS contexts, and discuss the need for increased and sustained international financing—including concessional resources, guarantees, and blended finance—for long-term recovery and reconstruction in FCS, recognizing the elevated risks and costs involved.

- Foster multi-stakeholder collaboration and coordination: Encourage greater alignment between donors, multilateral agencies, humanitarian actors, private sector investors, and national stakeholders in designing and financing recovery frameworks tailored to complex FCS contexts.

- Bridge the humanitarian-development-peace nexus in financing: Identify financing mechanisms that can more effectively support the transition from emergency response to climate-resilient recovery and sustainable reconstruction, especially in protracted crises.

- Advance climate financing for resilient recovery: Discuss how to scale up and tailor climate financing instruments—such as climate adaptation funds, green bonds, and carbon finance—to fragile and conflict-affected settings, ensuring that climate investments strengthen local resilience, support green reconstruction, and are accessible to the most vulnerable communities.

- Catalyze private sector engagement in recovery and resilience financing: Identify pathways for responsible private sector participation in reconstruction, including through de-risking tools, insurance instruments such as takaful, public-private partnerships, and ESG-aligned investment frameworks that support green, inclusive, and sustainable recovery.